A ‘climate solution’ takes off

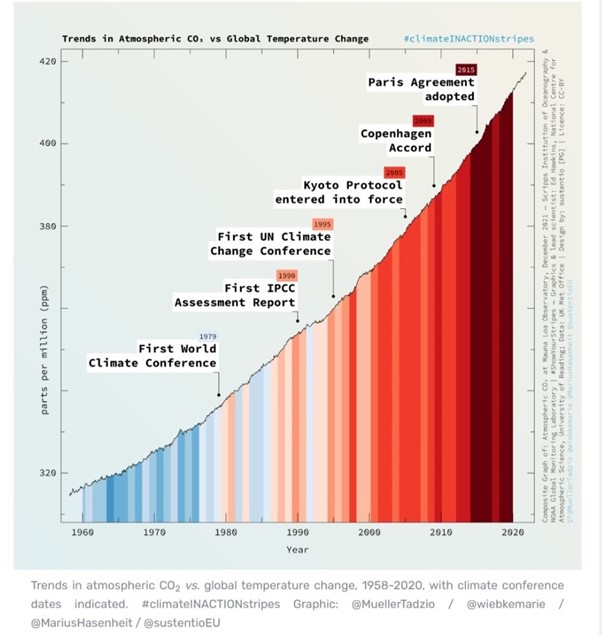

Carbon offsets claim to remove or avoid CO2 emissions. One ton of carbon offset credits cancels one ton of CO2 emissions, arriving at net-zero with a nice idea that any damage is repaired. Easy. KLM enabled travelers to offset their CO2 flight emissions with a small additional payment, providing peace of mind about causing upper atmosphere pollution. It diverts attention away from the fact that aviation emissions increased by about 30% in less than a decade. (Figure 1) It’s such a feel-good marketing tool, that it has become endemic in corporate marketing.[1] The voluntary market for carbon offsets is projected to reach $180 billion by 2030.[3]

KLM is now being sued for misleading the public that they are tackling climate change.[2] An international law firm warned in 2023 that because the VCM “is largely unregulated and fragmented, suffers from differing accounting methodologies and standards, and has been described as ‘the Wild West’ and ‘ ripe for fraud’”, they expect a coming wave of litigation around false or misleading claims of GHG reductions achieved via carbon offsets.[3]

From Kyoto to Carbon Offsets

that offer lower-cost CO2 emissions mitigation. In 2013, the UN established the REDD+ program in which carbon credits could be created by reducing deforestation and forest degradation. Carbon offsets credits are offered through companies such as the Verified Carbon Standard (VCS, managed by Verra), Gold Standard, the American Carbon Registry (ACR), and the Climate Action Reserve (CAR). Carbon offset credits, sold in the voluntary market to individuals and private corporations, have also been accepted in compliance markets, such as the EU ETS.

EU ETS and carbon offsets

Between 2008-2020, the EU ETS was the primary source of demand for CDM and JI carbon offset credits. It soon became clear that the value of these credits was questionable. In late 2012, the EU restricted CDM and JI offsets that didn’t meet qualitative criteria and banned offset credits from industrial gas projects. The EU also required Member States to set limits on what percentage of CDM and JI credits they would allow. [4] After 2021, carbon offsets have not been allowed in the EU ETS, but the possibility is still open for EU ETS2.

Really hot air

The story of industrial gas carbon offsets from the destruction of trifluoromethane (HFC-23) shows how the CDM program was gamed. HFC-23 is a byproduct of an ozone-depleting refrigerant (HCFC-22). HFC-23 is a ‘super greenhouse gas’ with a global warming potential 12,400 times that of CO2. It is supposed to be phased out and CDM projects were set up to incinerate it. Because producing it is cheap, and the number of credits it earns when it is destroyed is so high, these industrial gas factories seized the opportunity. Plant operators produced more HFC-23, just to harvest the windfall profits from destroying it.[4] Despite its intention, CDM stimulated a large increase in production, which has continued to spiral out of control. Research reported in Nature in 2020 alarmingly reported that the level of HFC-23 super greenhouse gas emissions in 2018 was higher than ever before observed.[5]

EC’s own 2016 report

In 2016, a report commissioned by the European Commission found that over 85% of the 5,600 CDM projects assessed had significant issues affecting their overall integrity. These encompassed various types of projects, including industrial gas or methane reduction, energy-related, lighting, and cookstove initiatives, all of which failed to deliver emission reductions. [6]

Forest fraud

Verra is the world’s leading carbon credit certifier, with nearly half its projects forest schemes. Despite Verra’s claims of a robust certification process, Danny Cullenward, a climate economist at the University of Pennsylvania, said that “every element of that process, when you dig in, is conducted by financially self-interested parties.” Verra’s outside ‘independent’ auditors who certify the reduction potential of the projects are hired and paid by the projects’ developers.[7] The auditors are therefore not independent and subject to a potential conflict of interest.[3] Other investigators have referred to it as structural corruption.[4]

The Guardian, Die Zeit and SourceMaterial, published the results of an investigation into forest carbon offset projects managed by Verra. The projects studied were worth 95 million carbon credits, enough to balance the emissions from 25 coal -fired power plants. They found that 94% of the credits were worthless and had no benefit to the climate. A 2022 Cambridge University study concluded that the threat to forests had been overstated by about 400% for Verra projects.[8]

Does money grow on trees?

South Pole, an influential climate consultancy with control over a fifth of the voluntary carbon market, served clients such as Gucci, Volkswagen, Ernst & Young. The Kariba Forest preservation project in Zimbabwe provided South Pole €25 million in 2022, about one tenth of South Pole’s revenue. By buying Kariba’s credits, Dutch energy supplier, Greenchoice, felt justified to claim they sold ‘sustainable gas’. [9]

The Kariba project, a partnership between South Pole and Zimbabwean entrepreneur, Steve Wentzel (through his company, CGI), started selling emission credits in 2013 based on a model severely biased in favor of South Pole’s investments. Over the last decade, auditors checked the scheme without ever checking the validity of the model, and Verra continued certifying them. By 2021, South Pole had fabricated 27 million extra tons of fake CO2 credits, almost twice the real 15 million carbon credits generated by the project. Despite knowing these credits were worthless, South Pole continued selling millions of them. Furthermore, South Pole kept more than 40% of the €100 million total Kariba revenue.[7][9]

Dead elephants, hippos, leopards, lions, buffalo, crocodiles and deer

How much of the Kariba project revenues went to the Zimbabwean people? South Pole has sent around €40 million to Wentzel’s company, CGI, and Wentzel claims to have spent €6 million on community projects. But there are no receipts to back it up.[7] A group of journalists visited the Kariba region to investigate whether any of the revenues had come back to the communities, but could not verify the promised investments in water wells, schools and healthcare clinics. [10] While there, the journalists uncovered Wentzel’s new venture. Instead of trying to preserve the dwindling populations of African animals in his nature preserve, Wentzel is profiting from the lucrative business of catering to a wealthy elite with the lust for hunting trophy kills.[10] Contractors arranging the safaris in South Pole’s Kariba area paid Wentzel hundreds of thousands of hundreds of dollars for hunting rights in 2018 and 2019.[10] Huge amounts of worthless credits are not exceptions, but the rule, as is exploitation by middlemen and poor treatment of communities.

90% of forest carbon credits are junk

A recent study in the journal, Science, revealed that 90% of carbon credits from projects claiming to compensate CO2 emissions by forest conservation (i.e. under the REDD+ program) do not actually offset carbon emissions.[11] One of the authors, Thales West from the Vrije Universiteit in Amsterdam, says, “We are fooling ourselves when we purchase these offsets. Individuals and organizations are spending billions of dollars on a climate change mitigation strategy that does not work, instead of investing this money into something that can actually make a difference, such as clean energy.”[12]

The top 50 of all projects

In 2022, the Guardian and independent researchers analyzed the top 50 most popular emission offset projects, which account for almost a third of the entire global voluntary carbon market.[13] These include forestry schemes, hydroelectric dams, solar and wind farms, waste disposal and greener household appliances schemes across 20 (mostly) developing countries. Of these projects, 78% were classified as likely junk, meaning that there was a compelling case that these projects were not able to deliver permanent greenhouse gas emissions reductions. Reasons cited were that the projects would have happened anyway, meaning they were not ‘additional’, they exaggerated the claimed GHG emissions reduction, they inflated the baseline, they were short-lived, or they caused emissions to happen elsewhere (leakage). The remaining 22% were either considered as problematic in that they have at least one fundamental failing, or there was not enough information about the project to evaluate it. [13]

Systematically unsound

That the VCM’s most popular projects have such questionable environmental efficacy suggests “that junk or overvalued carbon credits that exaggerate emission reduction benefits could be the norm.”[13] Indeed, researchers have found that the overvaluation of credits is systematic in the California carbon market.[14] An expert on carbon markets and law professor, Andrew Macintosh, has analyzed the Australian carbon market and come to the conclusion that 70-80% of the credits issued “are markedly low in integrity”.[15] It is important to note that an oversupply of credits keeps the price low.

Carbon extraction and colonizing effects

The overwhelming evidence is that carbon offset projects don’t reduce emissions. That these projects are often harmful to forest communities and their ecosystems has been reported since at least 2009.[16] They are set up without consultation with local and/or indigenous communities, who have done the most to protect nature, and who are the most harmed by these projects.

CDM biomass energy projects in Thailand were fueled by rice husks. The project developers did not consider that the local people used the rice husks as bedding for chickens, and later as fertilizer for their fields. When the rice husks were taken and burned, releasing their mineral content, the surrounding communities experienced high rates of silicosis and death, and became known as the widow villages. When more such biomass plants were planned, this time on a flood plain, the community resisted in the face of developers’ threats and coercion. After six years of organizing, the projects were finally cancelled. [16]

Landgrabs by wealthy developers exploiting vulnerable communities are not uncommon.[16] In a typical case, Ecuador allows mining companies to operate on indigenous lands, continually violently threatening indigenous people and degrading the ecosystem, which is supposedly protected under REDD+ agreements. Human rights abuses are linked to these projects.[17] In Peru, a large firm in the extraction industry forced the Kichwa community from their land in Cordillera Azul national park, while receiving nothing from the $87m agreement.[17],[18] Amazon Watch observes that “forest carbon market programs are based on the faulty premise that deforestation can be solved with marketization and investment, while ignoring problems of land rights, power relations, and building trust among communities.”[19]

Consensus against carbon offsets

In October 2021, more than 170 environmental and human rights organizations signed an open letter ahead of COP26 opposing carbon offsets.[20] In March 2023, 80 NGO’s wrote an open letter asking the EU to reject the use of carbon offsets after the mounting evidence of their failure to reduce emissions, as well as their harm to local ecosystems and communities.[21]

Conclusion

VCM integrity issues are not a bug, they’re a feature.[22] This market serves polluting industries’ need for low-cost pollution credits to avoid cleaning up their own emissions. Profit is an important motive. This monetarization of forests encourages land grabs, degradation of natural ecosystems, and human rights abuses. Undoubtedly, policy makers will try to brush up the rules again this year at COP28, but the fundamental structure is wrong. Emissions reductions need to be delivered from the big emitters, not from the few forests we have left. We don’t have time for elaborate avoidance schemes, which is what the carbon offset market is. To address climate change, the carbon majors need to stop new fossil fuel projects, and seriously ramp down the burning of fossil fuels. It’s time to take on the big money interests.

[1]Net Zero Tracker, (2023, June 12), Net zero targets among worlds largest companies double but credibility gaps undermine progress. https://zerotracker.net/insights/net-zero-targets-among-worlds-largest-companies-double-but-credibility-gaps-undermine-progress

[2] ClientEarth, (2023), Greenwashing lawsuit against KLM airline moves forward, https://www.clientearth.org/latest/latest-updates/news/we-re-joining-legal-action-against-dutch-airline-klm-for-greenwashing/

[3] Quinn Emanuel Trial Lawyers, (2022, September 7) Client alert: carbon offsets a coming wave of litigation? https://www.quinnemanuel.com/the-firm/publications/client-alert-carbon-offsets-a-coming-wave-of-litigation/

[4] Theuer, S., Hall, M., Eden, A., Krause, E., Haug, C., De Clara,S., (2023, January), International Carbon Action Partnership, Offset Use Across Emissions Trading Systems, https://icapcarbonaction.com/system/files/document/ICAP%20offsets%20paper_vfin.pdf

[5] Environmental Investigation Agency, (2020, January 21), Emissions of one of the worst greenhouse gases, https://eia-international.org/news/emissions-of-one-of-the-worst-greenhouse-gases-a-climate-crime-of-epic-proportions/ ; Stanley, K.M., Say, D., Mühle, J. et al. Increase in global emissions of HFC-23 despite near-total expected reductions. Nat Commun 11, 397 (2020). https://doi.org/10.1038/s41467-019-13899-4

[6] Cames, M. et al., (2016, March), How additional is the Clean Development Mechanism?, Oeko Institute for DG Clima (EC), https://climate.ec.europa.eu/system/files/2017-04/clean_dev_mechanism_en.pdf

[7] Blake, H. (2023, October 16), The Great Cash-for-Carbon Hustle, The New Yorker, https://www.newyorker.com/magazine/2023/10/23/the-great-cash-for-carbon-hustle

[8] Greenfield, P., (2023, January 18), Revealed: more than 90% of rainforest carbon offsets by biggest certifier are worthless, analysis shows, The Guardian, https://www.theguardian.com/environment/2023/jan/18/revealed-forest-carbon-offsets-biggest-provider-worthless-verra-aoe

[9] Crezee, B. and Gijzel, T., (2023, January 23), Showcase project by the world’s biggest carbon trader actually resulted in more carbon emissions, Follow the Money. https://www.ftm.eu/articles/south-pole-kariba-carbon-emission?share=aBZwSMswT7okzOm3pew9cN6xxB2En2PCSYc5UZqDCf427%2FRs4mJGurpfP%2BEGYWA%3D

[10] Gijzel, T., (2023, October 16), Shooting elephants and selling fictitious CO2 rights: South Pole facilitates both, Follow the Money. https://www.ftm.eu/articles/south-pole-kariba-big-game-hunting?share=%2BA5R79xjRMfw71nexsVp9nHHPnNevm38MhOQpehQak6%2FMbwMzNht5IFkhD6M9FE%3D

[11] Action needed to make carbon offsets from forest conservation work for climate change mitigation | Science

[12] https://vu.nl/en/news/2023/voluntary-carbon-credits-offset-nothing-more-than-hot-air

[13] Lakhani, N., (2023, September 19), Revealed: top carbon offset projects may not cut planet-heating emissions, The Guardian, https://www.theguardian.com/environment/2023/sep/19/do-carbon-credit-reduce-emissions-greenhouse-gases

[14] Badgley, G. et al., (2021, April 29) Systematic over-crediting of forest offsets, (carbon)plan, https://carbonplan.org/research/forest-offsets-explainer

[15] Long, S. and McDonald, A.m (2022, March 23), Insider blows whistle on Australia’s greenhouse gas reduction schemes, ABC News, https://www.abc.net.au/news/2022-03-24/insider-blows-whistle-on-greenhouse-gas-reduction-schemes/100933186

[16] Gilbertson, T. and Reyes, O., (2009) Carbon Trading-How it works and why it fails, Dag Hammarskjöld Foundation, http://www.daghammarskjold.se/wp-content/uploads/2014/08/cc7_web_low.pdf

[17] Human Rights Watch (2023, March 7), COP28: Carbon Market Rules Should Protect Rights, https://www.hrw.org/news/2023/03/07/cop28-carbon-market-rules-should-protect-rights

[18] Carbon Brief (2023, April 5), Carbon offsets scrutinised; UN water talks; IPCC beef and food fraud, Cropped 5 April 2023: Carbon offsets scrutinised; UN water talks; IPCC beef and food fraud – Carbon Brief

[19] Amazon Watch, (2022) A leaf out of an old book – how the LEAF coalition enables carbon market colonialism, https://amazonwatch.org/wp-content/uploads/2022/06/LEAF-Briefer-English-6-6-2022.pdf

[20] Amazon Watch and 170+ organizations, (2021, October 6), Environmental Justice and Human Rights Organizations Address Global Leaders Ahead of COP26: Carbon Offsets Don’t Stop Climate Change, https://amazonwatch.org/news/2021/1006-environmental-justice-and-human-rights-organizations-carbon-offsets-dont-stop-climate-change

[21] Global Forest Coalition. (2023, March), Call for the EU to reject carbon offsets following scandal of largest voluntary carbon offset certifier, https://globalforestcoalition.org/call-for-the-eu-to-reject-carbon-offsets/